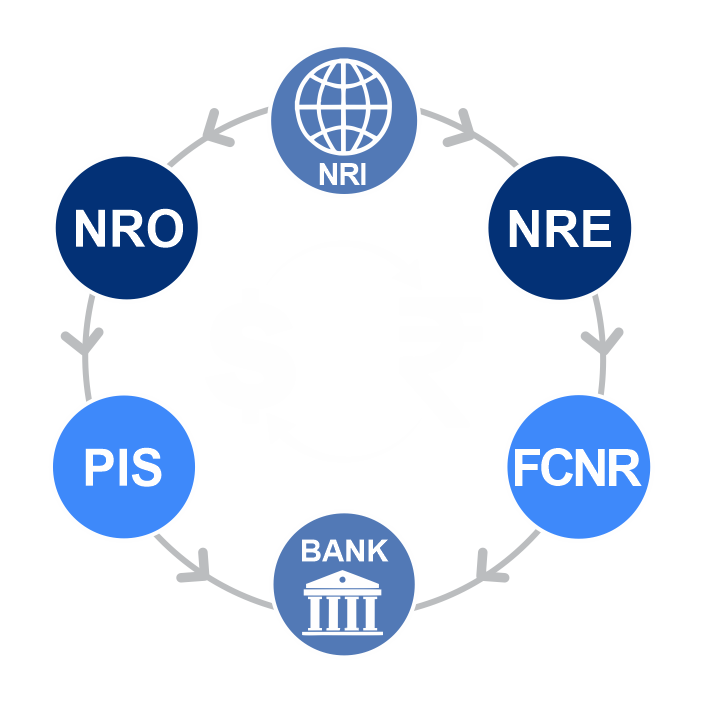

Opening an Account in India

We are here to assist with account that suits you

MARINERS

(NRI)

Non-Resident Indian

Non-Resident Indian

(OCI)

Overseas Citizenship of India

Overseas Citizenship of India

(PIO)

Person of Indian Origin

Person of Indian Origin

NRI

NRI

PIO

PIO

OCI

OCI

MARINERS

MARINERS